SUMMARY

This research precursor was conducted in Thailand and Vietnam to understand their rapidly rising social media commerce space, a potential market for Ninja Van to capture. We leveraged on the insights to inform the product and design strategy behind building the Ninja Biz App - a mobile order creation and management platform designed for shippers owning micro businesses and social media sellers who manage their shipping via mobile.

#product-strategy #design-strategy #user-research

⏰ TIMELINES

Exploratory research: Mar - Apr 2021

👩🏻💻 MY ROLE | LEAD PRODUCT DESIGNER

◾️ Strategic decision making on product and design direction collectively with Lead Product Manager

◾️ Co-led exploratory user research efforts with Research Hub

◾️ Led end-to-end research planning, execution and synthesis processes

◾️ Drove concept testing efforts with local shippers to validate design concepts

⚒️ TOOLS

◾️ Sketch, Miro, Dovetail, OBS

Note: This article will focus on the exploratory research efforts informing the product and design strategy for Ninja Biz App. If you’re looking for the follow-up on the end-to-end design process, proceed to this separate article instead.

🧪 The research behind Ninja Biz App

TL;DR

// ✍🏻 Research background: We observed a fast-growing segment of social media sellers in Thailand and Vietnam: merchants who operate entirely through platforms like Facebook, Instagram, LINE, and TikTok instead of traditional marketplaces. With Ninja Van’s footprint growing in these regions, our team set out to understand their unique needs and evaluate whether this was a segment worth building for.

————

// ⚠️ Challenges:

(1) Shift in strategy: Initially, we planned to explore chat integration workflows in depth. However, a strategic shift deprioritised that direction. Despite the pivot, the broader exploratory findings remained critical in shaping our MVP strategy—focusing on fine-tuning the fundamental shipping experience.

————

// 🧪 Research objectives:

(1) Exploratory research: Identifying the key jobs-to-be-done, frustrations, and compensatory behaviours of social media sellers in Thailand and Vietnam

(2) Concept testing: Validate early product concepts that support their workflows

// 👩🏻🔬 Research methods:

(1) Contextual inquiries with internal sales teams

(2) 12 in-depth remote user interviews across TH and VN

(3) Concept testing

PS: For the detailed decision making process behind how we determine our target audience, continue reading down below!

// 🚀 Outcomes:

The insights shaped the foundations of the Ninja Biz App—a mobile-first platform designed for autonomy, reliability, and simplicity.

[1] Planning the research

Problem background

Our business had long seen rising parcel volumes from non-marketplace sellers aka social media sellers in Southeast Asia. Anecdotally, these were social sellers running businesses on Facebook, Instagram, LINE and Tiktok. But beyond volume, we didn’t really know who these sellers were or how they worked. To avoid designing in the dark, I co-led a cross-functional research initiative with the Research Hub and sales teams in Thailand and Vietnam to deeply understand these sellers' needs, behaviours, and existing pain points.

Before speaking with any sellers, we also conducted contextual inquiries with our sales teams. We quickly learned that sellers saw Ninja Van as unreliable and hard to use—particularly on mobile. Our sales teams often had no leverage beyond price, which was unsustainable long-term. It became clear that if we wanted to serve this market well, we had to fix foundational issues first.

PS: I’ll focus on the planning, execution and synthesis of the exploratory research in this read. For a more holistic breakdown on the size of the problem, read here.

User research plan

“The following summarises the key points in our User Research Plan (URP). For research, a URP is often used as the key source of truth for documenting and aligning on the project’s background, research objectives and logistical details.”

Research approach

We designed the study using a blend of qualitative methods

Recruitment strategy

Our participants ranged from sellers fulfilling 10 orders a day to those handling over 800. We intentionally sampled across levels of business maturity, and included both active and lapsed Ninja Van users. We also screened for sellers who had tried multiple logistics providers like Flash, GHTK, and Kerry to uncover gaps in our service experience.

Example of how we screen for participants - This is a non-exhaustive snapshot into how we screened for participants to ensure that we find the right profile of sellers from the get-go to maximise our insights saturation.

Once the research direction is clear, I focused on generating the research materials to guide the study.

[2.1] Insights: Who are these social media sellers, really?

We conducted over 20 hours of qualitative interviews with 12 participants—spanning small and large social sellers, lapsed and active Ninja Van users across Thailand and Vietnam. I hosted most of the sessions, and supported as the main note-taker in others, in collaboration with my researcher.

Spending time with social media sellers gave us clarity beyond just workflows—it revealed deep mismatches between how they operate and what our product offers today.

❓So…Who are the social media sellers and how do they behave differently from traditional sellers?

What we’ve discovered wrt seller maturity and usage of tools ✨

(1) They actively avoid marketplaces like Shopee and Lazada

“If I sell on Shopee, the orders would be too many. I can’t handle them.”

Why? Fear of overwhelming volume, rigid platform rules, and high fees.

What they want: Full control over pricing, branding, and customer relationships.

(2) Their workflows are deeply relationship-driven

Every sale begins and ends in a conversation.

Sellers often respond to each customer manually, averaging 20+ minutes per sale.

Trust is built through direct interaction—any automation must preserve this behaviour.

🥰 In essence, relationships drive conversions, and sellers are wary of any tool that may compromise that.

(3) They rely on patchwork systems to scale

Most sellers use 4–5 tools (e.g., Messenger, spreadsheets, livestream tools).

Some hire helpers just to type orders, others outsource to sales agents.

Their processes are manual by necessity—not by choice.

💡 Design implication

These are highly adaptive sellers who value control and human connection. Our job wasn’t to automate them out of the process—but to support them in scaling their way.

[2.2] Insights: What resonated - and what didn’t in concept testing?

While discovering insights about the sellers’ behaviour, we also took the opportunity to conduct concept testing with them. With some consultation help from the Head of Design, I led the concept test design and low-fidelity prototyping.

We tested low-fidelity prototypes simulating real-world scenarios: creating orders, syncing chats, printing labels, and viewing COD balances. We intentionally kept the concepts low-fidelity to invite open-ended feedback and reduce usability bias. Some ideas sparked immediate interest. Others met hesitation. Here’s what stood out:

💡 Design implication

Most sellers preferred to manage their own operations, but the tools had to be simple, reliable, and fast. What really stood out: trust was make-or-break. A failed COD payout, a glitchy app experience, or a delivery gone wrong? That was often enough for them to churn and switch providers.

[3] From ideal to impact: What changed, and what didn’t?

My Lead Product Manager and I originally envisioned a fully chat-integrated logistics platform. But as the business pivoted toward launching a leaner, more focused mobile-first, self-serve experience MVP (Dash 2.0 - read it here!), we had to pause those ambitions to focus on fine-tuning the fundamental shipping experience. This shift also echoes with the sellers’ mental model, where simplicity and reliability in tools will encourage them to use us and stay with us in the longer term.

Still, the research gave us clarity: we knew which problems to solve first, and which to save for later. The biggest win? Anchoring our product roadmap in merchant reality, not assumptions.

Example of outputs that shaped the strategy

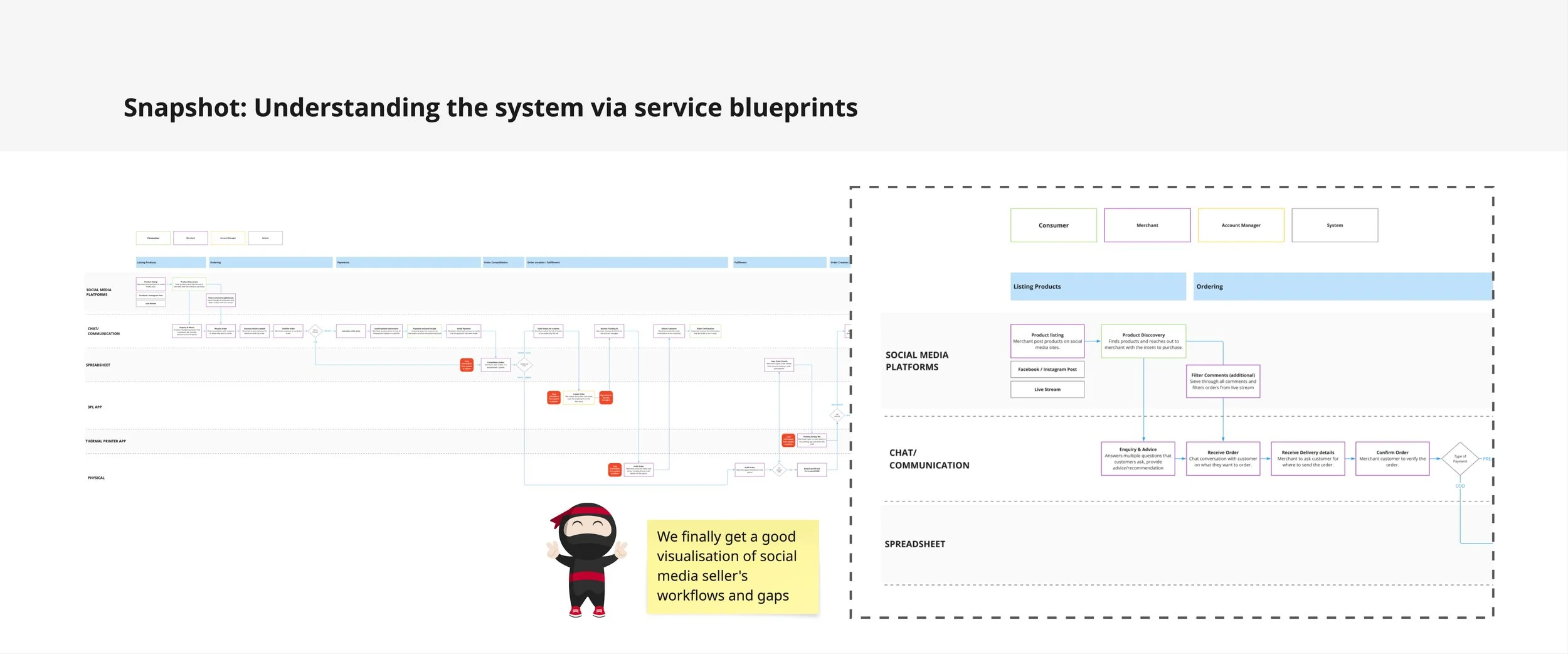

📌 1. Clear user archetypes, service blueprints & operational maturity spectrum

We synthesised social media sellers into a spectrum from manual to tool-assisted operators, each with distinct workflows, needs, and limitations. This became foundational in helping product and marketing teams identify who our MVP was for, and who it wasn’t (yet).

✅ How it was used:

Product narrowed MVP scope to target sellers who are manual operators.

Product messaging shifted toward clarity, control, and trust—not automation.

📌 2. Prioritised value drivers based on JTBD and pain points

We mapped out seller workflows into core jobs: order capturing, order creation, COD tracking, and label printing. This gave us a concrete view of what sellers value most, what they struggle with, and what features would unblock progress.

✅ How it was used:

Design team used this as the backbone for our user stories and revamped our information architecture of the product.

COD visibility and label printing were bumped up in design priority.

By grounding ourselves in real seller pain points, we avoided the trap of building prematurely for complexity. Instead, we delivered clarity to the business, alignment across teams, and a stronger product foundation. The research helped us shift from designing for potential, to designing for adoption.

[4] Bonus insights: My experience as a live-seller!

💡 How I work with limited resources #3:

In the midst of this research, I wanted to understand what it truly felt like to be in their shoes. So I became a live seller myself, and shared this experience with my product and design team.

It started with my accidental discovery of the crystal community in Singapore. I’d spend weekends browsing Instagram lives, slowly building connections within the crystal community in Singapore. Eventually, I started sourcing stones from these local sellers, and sellers in China, then handcrafting bracelets from home—mixing stones by intention and aesthetic, threading each one with care.

I decided to try live selling on Instagram, just like many of the sellers we were studying. I still remember how nerve-wracking it was the first time I went live. Keeping the energy up, managing comments, replying to DMs while trying to remember who ordered what—it was chaos, but it was also deeply human

PS: no pictures, but here’s an illustration (:

There was no backend system, no order flow. Just me, my viewers, and a notebook where I scribbled down orders as fast as I could. I made new friends through those sessions and had local buyers who kept coming back for new drops. I experienced the community, and trust that other social media sellers cared deeply about.

That experience gave me a much deeper insight into how I viewed our users. I began to truly appreciate the rigour and resourcefulness it takes to run a business this way. Many of them are one-person teams—selling, chatting, fulfilling, tracking, all at once—while still finding creative ways to engage their communities and build trust with every order. Being in their shoes, even briefly, made it clear just how much mental load they carry behind the scenes. It deepened my empathy and gave me a stronger sense of responsibility to advocate for their needs throughout the product design process.

☕️ PPS: If you're curious about conducting localised research, or want to chat about designing for overlooked user segments—feel free to reach out! 🌝