SUMMARY

The Ninja Biz App is a mobile order creation and management platform designed for shippers not operating on marketplaces like Shopee or Lazada, complementing the existing Ninja Dashboard on the web. It focuses on meeting the needs of self-serve shippers—micro businesses and social media sellers who manage their shipping via mobile.

#product-strategy #design-strategy #end-to-end

⏰ TIMELINES

Exploratory research: Mar - Apr 2021

Design & development: May to Dec 2021

~6-8 months in total

👩🏻💻 MY ROLE | LEAD PRODUCT DESIGNER

◾️ Strategic decision making on product and design direction collectively with Lead Product Manager

◾️ Co-led exploratory user research efforts with Research Hub

◾️ Led end-to-end design process, managing 1x Product Designer

◾️ Drove cross-vertical and cross- functional collaboration across 3 squads

◾️ Managed and delegated component designs with Design System team

⚒️ TOOLS

◾️ Sketch, Zeplin, Miro, JIRA, Mixpanel

Note: This article will focus on the end-to-end design process, decisions & challenges behind revamping our shippers’ mobile experience and bringing the Ninja Biz App from 0 to 1. Any prior research studies or in-depth exploration on key features can be found in separate articles.

📱 Ninja Biz App

TL;DR

// ✍🏻 Background: While the Ninja Dashboard was initially built for desktop users, the rise of social commerce highlighted a gap in serving mobile-centric shippers. In markets like Thailand, nearly 49% of shippers prefer booking shipments via mobile app, prompting the need for a more mobile-centric experience.

————

// ⚠️ Challenges:

(1) Legacy architecture: Balancing the need to modernise the user experience while maintaining legacy systems and differentiating from competitors was a key challenge. We decided that it was easier to build a mobile app from scratch rather than tweaking the mobile web experience that was burdened by legacy architecture and codebase.

(2) Team alignment: The cross-functional team, consisting of diverse stakeholders with strong opinions, struggled with agreeing on a shared outcome and strategic direction, causing delays at the outset.

————

// 🚀 Outcomes:

(1) Business outcome: Increased share of parcel volumes from self-serve shipper segments.

(2) User outcome: Reduced friction for self-serve shippers to ship orders quickly from their fingertips.

(3) Product outcome: Unified cross-platform experience between the mobile app and web-based Ninja Dashboard.

// 🛠️ Approach: Focused on mobile-centric, self-serve features that addressed the logistics needs of shippers on-the-go (phase 1). We prioritised delivering an optimal mobile experience before unifying the platform across devices (phase 2).

[1] Sizing the opportunity

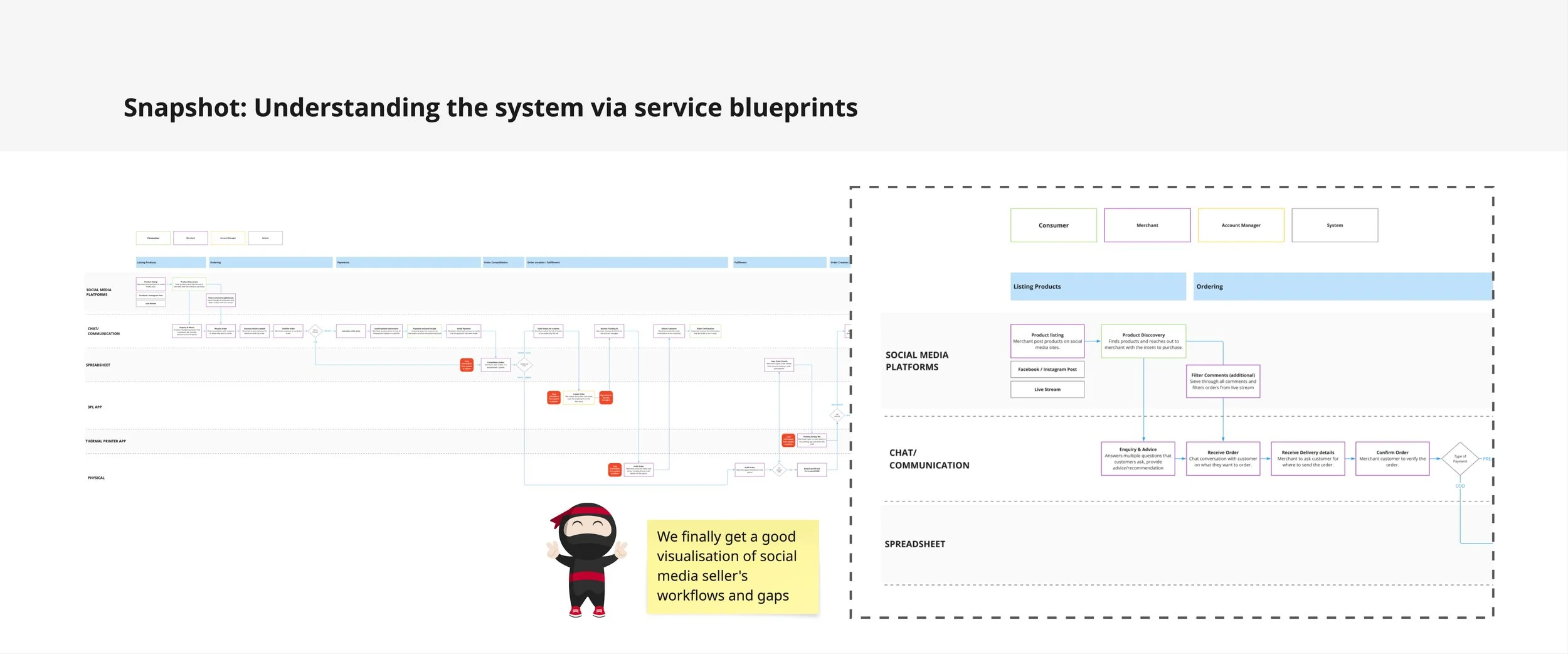

In April 2021, I co-led a research study with Ninja Van’s Research Hub, interviewing shippers in Thailand and Vietnam to understand their social media selling behaviors. We discovered that TikTok and Instagram live sales were booming, particularly among micro-business owners and small sellers who hadn’t yet tapped into larger marketplaces like Shopee and Lazada. This presented an opportunity for Ninja Van to expand its services to cater to these smaller-scale sellers without reliance on marketplaces.

Our market research showed that these sellers—typically shipping 30 parcels or fewer per day—represent up to 80% of the market share across six Southeast Asian regions where Ninja Van operates. Another key metric that stood out was Ninja Van's 20% market share among these shippers, compared to a competitor's 50%. This highlighted the need to establish our product's superiority in order to break into a very limited consideration set—most shippers typically use just two 3rd-party logistics partners (3PLs) at a time.

Our collective strategy:

The biggest opportunity lay with social media sellers who aren’t yet on marketplaces. Omnichannel sellers typically funnel social media orders to marketplaces for better shipping rates, while marketplace-focused sellers view social media as marketing rather than a sales channel. This left us with a sizable target segment, aka the social media sellers, for self-service logistics. We call this segment the self-serve shippers.

Based on our collective findings, my product team and the Commercial business stakeholders aligned on the need for a self-service solution (hence the segment’s name). These sellers, often juggling multiple roles, had two main needs:

A strong demand for highly optimised self-service 3PL (third-party logistics) services to save time.

Centralised decision-making, with these owners making the key decisions on logistics and shipping.

[2] The need for a solution

I was the Lead Product Designer for this project, with a new Product Designer who joined my team as an additional resource. To tap into this target segment, we designers collaborated with our Lead PM and her team of two PMs to re-evaluate our current service offerings, focusing on the Ninja Dashboard and its mobile-web counterpart. One key insight from our behavioral studies was that these shippers, while conducting sales online and on mobile, also manage their day-to-day operations on their phones. As on-the-go business owners, they value the flexibility of managing everything from anywhere.

The people that made this happen ✨

We realized that enabling order booking through a robust mobile app could serve about a third of this segment, as many still relied on less efficient methods like desktops or salespeople. At the same time, we found that resolving delivery issues through quick human interaction, rather than self-service, would be more effective.

In parallel, we worked closely with senior engineering managers and tech leads across multiple teams to evaluate the existing legacy codebase. After assessing its limitations, we determined that a full revamp and rebuild of the mobile app would be the most cost-effective and timely approach to meet our goals. The decision was made to launch the new app by the end of the year, to enable the sales team to capture this target segment in the new financial quarter.

This insight drove us to kick off a mobile app revamp, codename Dash 2.0. Over the next 6-8 months, we audited the existing web and mobile-web experience rigorously, catered for more mobile-centric experience, and launched the new Ninja Biz App to better meet the needs of our self-serve shippers.

Success metrics

As we’re looking at acquiring a new segment of shippers, the success metrics will be to measure the activation rate of the shippers. A shipper is activated when he/she completes their first order creation on the mobile app.

[3] Planning: Key principles of working and decision making

For large end-to-end projects like the mobile app revamp, effective planning was crucial to ensure we focused on the highest-impact changes. Together with my Lead PM, we established clear principles that guided our decision-making process and kept the team aligned throughout.

(1) Ruthlessly prioritising user stories and features

Using an audit and user story mapping, we broke down key user flows and identified essential features.

Prioritised "must-haves" over "nice-to-haves," aligning the roadmap with the core needs of the business and the self-serve shippers.

We repeated this mapping for all key user flows, user stories and feature mapping 💀

(2) Optimising for mobile-first experience

Restructured the information architecture to ensure a seamless mobile experience.

Deprioritised complex workflows that offered minimal value to self-serve shippers or the mobile platform, allowing us to focus on what truly mattered.

Keeping things accessible with shared IA structures 📝

(3) Iterating fast, learning fast

Introduced a design timeline to visualise the workflow and improve project management.

Implemented a staggered agile workflow, allowing for continuous cycles of product, design, and development for each key user flow.

This approach enabled incremental deliveries and quick iteration, ensuring we adapted based on feedback.

Our agile workflow to coordinate 3 squads, and a design timeline to visualise clear milestones.

(4) Setting up core design practices and documentation standards

From a design perspective, key principles and practices for documentation were implemented to ensure clarity and consistency.

Pioneered an indexing logic for documenting key user flows, sub-flows and their respective screens, making it easier for the team to access and reference critical information - with help from the Head of Design.

Drove best practices for ✨ design specification - read more about the practice here - ✨ to ensure that all key design and product decisions were documented with strict attention to detail.

A snapshot of how we write and refine design specifications in Ninja Van

[4] The team’s challenges

Challenge #1

One major challenge at the start of the project was aligning the cross-functional team. With diverse stakeholders holding strong opinions, it was difficult to agree on a shared outcome and strategic direction, leading to significant delays.

➡️ Key scenario:

An example of this challenge came from my experience working closely with the Head of Design during the planning and execution of the revamp. While I truly appreciated his contributions and enthusiasm in helping set up key design practices and fighting for the right decisions, I began to notice that the team’s morale and productivity were suffering due to the sheer amount of overhead.

For weeks, we found ourselves stuck in endless discussions, delaying the completion of our first key user flow. It became clear that we needed to address the issue head-on. After much reflection, we decided to escalate the problem and clarify everyone’s roles and responsibilities.

We agreed that the Head of Design would step back from the day-to-day design and development work and take on more of a consultative role.

This shift allowed the team to finally move forward with a unified vision while also freeing up his capacity to focus on other important priorities for the organization.

🍀 Looking back, it was a tough but necessary decision that ultimately helped us regain momentum and work more effectively together /phew/ 😰

Challenge #2

We quickly recognised another major challenge early on: balancing legacy architecture with the need to modernise the user experience. We found ourselves at a crossroads, debating whether to improve the mobile web experience, which was constrained by outdated systems, or take a more innovative (but risky) approach and build a new app from scratch. After evaluating the technical feasibility and the effort involved, we concluded that starting fresh with a new app was the most viable solution. This decision allowed us to break free from the limitations of the legacy system and deliver a modern, mobile-centric experience that aligned better with our goals.

However, even after agreeing on the app rebuild, we still had to wrestle with the existing backend logic and how it impacted our design decisions as we dug deeper into ~10 key user flows and ~20 sub-flows.

➡️ Key scenario:

A good example of this challenge came up during the design of the [0.1 Access Account] user flow. While designing for Southeast Asian (SEA) shippers, we debated whether to use a mobile phone number or an email address as the primary method for users to access the app.

Mobile phone numbers were familiar and commonly requested due to SEA’s strong e-commerce culture, but the risk was that frequent number changes could lead to users losing access to their accounts.

On the other hand, email addresses offered more stability and security but were less convenient for SEA users, who found email logins cumbersome.

To complicate matters, our backend systems were built around a mix of both mobile phone numbers and email addresses as primary identifiers - an approach based on long-standing country-specific requirements.

🍀 After carefully considering all risks and options, we decided to standardise email addresses as the primary identifier across both the front-end and back-end. This provided long-term stability while allowing us to record the mobile phone number for future multi-factor authentication. This decision not only met the needs of SEA shippers but also aligned with our broader goal of creating a scalable and secure mobile-centric solution, helping us navigate both the legacy system limitations and our design challenges.

[5] Snapshots: Designing key user flows & features

Our outcome is to have reduced friction for self-serve shippers to ship orders quickly from their fingertips. The main jobs-to-be-done here is for shippers to enable them to create orders as quickly as possible using their mobile phones, so that they can get the orders out to their customers within reasonable time. The following is a couple of snapshots of how we addressed the users’ needs based on top issues synthesised from past research and data.

Here you can see an overview of the scale of the design work needed for this huge project

📝 Note: For a more in-depth exploration of the design decisions, user flows, and specific challenges we encountered throughout the project, I’ll be linking to additional articles - TBD - that provide a detailed deep dive into key user flows. Each one will offer a closer look at the processes behind the decisions that shaped the final mobile app experience.

💪🏻 It was also an exciting challenge for me to coordinate the development of the components with the Akira design system team, in parallel with handing over the specifications to the engineers. FYI, Ninja Van’s products are notorious for being only functional, and nothing else 🫠.

What was fun for me was seeing how the developers found joy in building something that FINALLY looks good and feels good 🤣, it helped to push them beyond their comfort zone to explore micro-animation of the Ryo ninja character - vroom vroom💨!

Repeat this coordination for 50+ times and you’ll get a designer with a melted brain 🫠

Clearly I went crazy…..

Seeing everything pieced together is pretty awesome ngl! 🥰

[6] Conclusion: Outcomes

Biz outcome

By early January 2022, we successfully delivered Ninja Biz App, a mobile-centric solution that better met the needs of our self-serve shippers, addressing both user pain points and business objectives. This app was launched to a beta group of shippers, before being released to self-serve shippers in Vietnam primarily - and 5 other SEA countries in future phased rollouts - via Google Play Store and the App Store.

User outcome

Self-serve shippers can now efficiently manage their orders with minimal friction on their mobile phones, allowing them to ship products quickly and focus on growing their businesses. By addressing some of the aforementioned key pain points—such as the inability to print shipping labels, the cumbersome order creation process, and the difficulty in communicating parcel progress with customers—we’ve streamlined their workflows, making it easier for them to complete orders from their mobile phones. Examples of positive impact include achieving an initial CSAT score of 72.8 for the creating orders on Ninja Biz App and growing from 0 to 4-5k monthly active users from February - May 2022 post-launch.

Design practices outcome

A surprising effect stemmed from the design practices we introduced—such as the indexing logic, rigorous design specifications standards, user story mapping, a staggered agile workflow and the insane mid-fidelity wireframe components on Miro!!!—also further influenced other designers and product managers to adopt these methods in their own projects e.g. in the internal Driver App.

The design specification framework was an example of such influence, where I became the evangelist for the design practice by organising workshops and training designers to adopt it in their day-to-day work - read more about the framework here 🌻. This brought about faster delivery time as we raised our design standards with clearer design requirements. Seeing these practices spread across the tech organisation reinforced the impact that strong design processes can have, not just on a single project, but on broader team culture and efficiency.